Destination Development

In May, the Destination Development team continued to work on the DestinationNEXT survey to ensure that the efforts of the CVB, our Partners and the nine cities are in alignment. CVB Partners, Board Members, government and elected staff, civic organizations, meeting and travel professionals, Greater Palm Springs Certified Tourism Ambassadors and CVB staff completed a total of 481 surveys. Paul Quimet, with NEXTFactor Enterprise Inc., will present the survey results at the CVB Board Meeting on June 28.

The team also rolled out Restaurant Week 2019 (May 31–June 9), kicking off the event at The Ritz-Carlton, Rancho Mirage on Wednesday, May 29. A record number of 121 restaurants participated in Restaurant Week this year.

In support of air service development, the CVB attended the Jumpstart annual Air Service Development conference in Nashville, Tennessee, along with Ailevon Pacific. We met with 13 airlines: seven that currently service the airport and six that are exploring potential service at PSP.

-

Greater Palm Springs Destination Assessment

The CVB has contracted DestinationNEXT to survey our tourism, government, education and business Partners in Greater Palm Springs. The goal of the survey is to determine if there are any gaps, key issues and opportunities for potential products, amenities, education, programming and experiences that would benefit the Greater Palm Springs tourism industry and grow the local economy.

The study covers 20 topics in 5 sections with a max number of 184 questions per survey. The questions are specific to Greater Palm Springs as a destination as well as to each of the 9 cities.

There were 483 people who completed the survey.

Organizations

Surveys

CVB Partners

207

CVB Board Members

28

Government Elected and Staff

71

Civic Organizations

32

Meeting Professionals

53

Travel Professionals

18

CTA

20

CVB Staff

54

Total

483

-

Restaurant Week May 31–June 9

The Greater Palm Springs Restaurant Week kickoff event took place Wednesday, May 29 at The Ritz-Carlton, Rancho Mirage. Participating restaurants included 360 Sports, AC3 Restaurant + Bar, Babe’s Bar-B-Que & Brewery, Catalan Mediterranean Cuisine, Citrus & Palm Restaurant, Solano’s West Coast Bistro, State Fare Bar + Kitchen, Grand Central Palm Springs and Lulu California Bistro. Agua Caliente Casinos were the presenting sponsors, and participating sponsors included Sysco and Cambria.

Greater Palm Springs Restaurant Week Kickoff

When comparing the first 10 days of Restaurant Week from 2018 to this year's 10-day event, Restaurant Week website sessions increased by 5.6% over the 2018 event to reach 48,740 sessions. There were 94,663 restaurant menu views. The top five areas where visitor sessions came from were Palm Desert (19.8%), Palm Springs (14.5%), San Diego (8.7%), Los Angeles (8.3%) and Indio (7.9%). Use of mobile devices accounted for more than half of all traffic at 52.8% of all visitors to the Restaurant Week site, followed by 32% desktop computers and 15.2% tablet.

Social Media promotion of Greater Palm Springs Restaurant Week garnered over 930,000 impressions, an impressive 383% increase from 2018. Facebook event responses also increased by 126% to 1,189 responses. Top markets of those who responded include Palm Springs, Palm Desert, Los Angeles and San Diego. New this year, the CVB ran a promotion prior to Restaurant Week for newsletter sign-ups resulting in over 2,500 new email subscribers.

The CVB brought three influencers into the destination to promote Restaurant Week. Their content accounted for 130,000 of the total impressions listed above. These three influencers each took over a day of the CVB’s dineGPS Instagram account as well as posted on their own accounts for three days. Visual assets were also delivered from their visit to include in future promotions of dineGPS.

With the dineGPS campaign continuing throughout the year, our social channels have increased in followers since 2018. dineGPS Facebook has surpassed 11,000 followers, dineGPS Instagram over 1,400 and dineGPS Twitter over 3,200 followers.

-

Greater Palm Springs Tourism Foundation

The Greater Palm Springs Tourism Foundation was established in 2018 with a dynamic mission to enrich and elevate tourism in the region. The Foundation supports and initiates diverse programming related to the hospitality, convention and tourism industries with funds raised from the general public and other sources. Initiatives encompass providing education and leadership training, college scholarships, volunteer and mentor development, special event promotion and cultural enhancement.

May 2019 Tourism Foundation Highlights

The Greater Palm Springs Tourism Foundation continued the CVB’s tradition of awarding scholarships at the 2019 Oasis Awards to deserving high school students from the Coachella Valley High School Hospitality Academy. The Foundation was able to raise $9,000 to award 6 students $1,500 each toward their college education expenses.This year’s are:

- Noemi Aguilar

- Luis Alvarado

- Adrian Garcia

- Ruben Leon

- Elizabeth Olivas

- Kasey Villarreal

Tourism Foundation Scholarship recipients

The Foundation has also received $170 to date through its partnership with Lifestream. Donors wishing to contribute to the Tourism Foundation through their Lifestream blood or platelet donation can use the code 9MTS.

The Tourism Foundation also has a partnership with CVSpin for the Tour De Palm Springs, which has contributed $310 to the Foundation. Participants can register using code 20CVB to have a portion of their registration contributed to the Tourism Foundation.

If you have any questions, please contact Chief Development Officer Bob Thibault at 760-969-1339 or bthibault@gpscvb.com.

-

Air Service

May was another record month for Palm Springs International Airport. Total passengers are up 13.1% to 190,756. January through May, PSP is up 16.2% with total passengers of 1,495,856.

JumpStart 2019 Conference June 3-6, 2019

The annual Air Service Development conference (Jumpstart) took place in Nashville, Tennessee, June 3-6. Bob Thibault from the CVB, Oliver Lamb from Ailevon Pacific Aviation Consulting (APAC), and Carrie Kelly, also from APAC, represented Palm Springs when meeting with 13 airlines: seven currently serving PSP and six that are exploring service in the future. The meetings with the airlines that currently serve PSP included Air Canada, Alaska, American, Delta, Flair, JetBlue, WestJet. The meetings with the airlines that do not currently have operations at PSP included Contour, Fly Louie, Hawaiian, JetSuite X, Southwest and Spirit. In addition to the 13 meetings, we visited United Airlines at their headquarters on May 7. The highlights of all 14 meetings are listed below.Current Airlines at PSP

• Air Canada: Air Canada informed us they will not be returning to the Calgary (YYC) market this coming season. In lieu of the YYC exit, they will add frequencies to the Toronto (YYZ) market, increasing Toronto-Palm Springs to daily. Air Canada will also look at what they can do to extend the season of Vancouver-Palm Springs. Calgary is home to WestJet’s headquarters and its largest city by capacity while Toronto is Air Canada’s largest city by capacity.

• Alaska Airlines: This was our last meeting of the conference, and it turned out to be the most exciting, as PSP’s largest carrier, by seats and passengers, announced they will be starting service to Paine Field (PAE) in Everett, Washington, on November 5 with once per day service on a 76-seat Embraer 175. PSP was the most searched unserved market from PAE. The overall sentiment of Alaska’s PSP performance was positive. Medium- to long-term opportunities could be San Jose (SJC) and Spokane (SEA).

• American Airlines: Overall, American has been pleased with its recent performance in PSP, with some minor concerns with Chicago (ORD) due to the extra capacity last season from American, United and new entrant Frontier. Coupled with the grounding of their 737 MAXs, which roughly affects 115 flights per day, they postponed the start date of ORD service until October 20 instead of early October. However, we asked what it would take for the airline to reconsider an earlier start date, as dynamics have changed. After a post-Jumpstart phone call with American, the airline found an aircraft and will start once-per-day service from ORD on October 3, 2019, which will be published on Saturday, June 22.

• Delta Air Lines: We had a very positive meeting with Delta. They were extremely pleased with their Saturday-only and daily holiday service to Atlanta (ATL) in the 2018/2019 season and will return with 5x weekly service for the 2019/2020 season (every day except Tuesdays and Wednesdays). Our ask was for Delta to look at extending the season of Minneapolis (MSP), and the airline responded that the MSP market could warrant that, but they are tight on their ASM budget to expand the season. After the Jumpstart conference, however, we received notice that Delta will add a second flight to the Seattle (SEA) market to be more competitive. The second fight will start in late December and will be published on June 22.

• Flair Airlines: This Canadian low-cost airline was a new entrant in PSP for the 2018/2019 season. They will not be returning to PSP or any of the other 5 U.S. cities they flew to until 2021. The airline plans to shift its focus to building their presence in the Canadian domestic market. Flair will keep Palm Springs front-of-mind when they return to U.S. markets.

• JetBlue Airways: JetBlue’s performance this past 2018/2019 season was weaker than years past, but the airline is aware of the competitive dynamics in the New York market—United’s entry into Newark (EWR)—and will resume service to JFK on October 9, 2019. They will continue to evaluate a service extension for the JFK route. We asked if they could consider switching one of the flights, JFK or BOS, from a red-eye to a daytime flight, but they did not seem to have an appetite for that due to aircraft constraints. United’s EWR service is also a red-eye, which could have affected overall Northeast performance since we had three red-eyes this season.

• United Airlines (HQ visit): We met with the planners and managers of the Newark (EWR), Houston (IAH), Denver (DEN) and Los Angeles (LAX) hubs and had dinner later that evening with the domestic Director of Network Planning. It was a productive day. United informed us that they do well in PSP, but this past year—with their capacity increases coupled with all other airline’s capacity increases—the market was weaker this past season. United’s newest PSP market, EWR, had lower than expected performance, but the service will be returning next year just with reduced frequencies. We pitched service extension to IAH and/or Chicago (ORD), and the airline said they will continue to evaluate it but that it is a hard case to make due to their ASM and aircraft constraints. They potentially might seasonally exit the LAX market in the summer, as it is a SkyWest maintenance market and might transfer the maintenance over to another airport. Overall, United said they expected its capacity in Palm Springs to remain flat.

• WestJet: WestJet is PSP’s largest international airline and overall fourth largest airline. WestJet was the only airline in the 2018/2019 season that did not add seat capacity due to its Toronto (YYZ) exit year-over-year. However, the airline is very pleased with its four other Canadian markets. We informed them that Air Canada is not returning to Calgary (YYC) next year, and the WestJet planners responded that there would be value in adding capacity in this market but they are heavily constrained with aircraft—yet will see what is possible for the 2019/2020 season. Separately, when WestJet begins to plan its summer 2020 schedule in the next few months, they will evaluate additional capacity to Vancouver (YVR) in the summer months.Potential Airlines at PSP

• Contour Airlines: Contour is a small airline that has scheduled low-fare service on the 30-seat Embraer 135s. The airline recently added service between Santa Barbara and Sacramento, Oakland and Las Vegas. The airline took Bob and Oliver on a tour of their headquarters at the Nashville Airport. We are in advanced conversations with Contour about launching daily Sacramento (SMF)-Palm Springs flights. Contour is also interested in Oakland-Palm Springs and Las Vegas-Palm Springs flights.

• Fly Louie: Founded in 2017, this new airline is focused on operating scheduled services but making the experience similar to flying on a private jet. They are primarily based in the Northeast. One of its employees used to work at JetBlue and is very familiar with PSP. He said as the airline continues to grow and expand west, if Contour or JetSuite X has not entered PSP, they will definitely take a hard look.

• Hawaiian Airlines: Hawaiian is looking at potential opportunities to grow its West Coast presence, especially as they receive more narrow-body aircraft. Hawaiian is also interested in the potential to feed South Pacific (Australia/NZ) demand to PSP over its Honolulu hub. This was an informational meeting where we shared PSP-to-Hawaii market dynamics, particularly how difficult it is to get between the two destinations.

• JetSuite X: This fairly new airline (2015) focuses on offering private-like air travel but with short-haul scheduled service. They operate out of private terminals that they prefer to operate themselves. The airline currently has service only on the West Coast, Las Vegas and Phoenix and is looking to expand in the region. They plan to double their fleet from 11 aircraft last year to 17 this year and to 30-35 by the end of next year. Their target market is affluent regular travelers, and they see Palm Springs as an ideal fit. They are looking at potential service from PSP to Oakland (OAK), Sacramento (SMF), San Jose (SJC), Reno (RNO), Las Vegas (LAS) and perhaps later on Burbank (BUR) and Orange County (SNA).

• Spirit Airlines: Spirit is an ultra-low-cost carrier (like Allegiant, Frontier and Sun Country) and is in growth mode. The airline will have 35 additional large aircraft by 2021. Spirit’s target market is leisure travelers seeking out low-fare service and value-driven travel, which is why the airline would be looking at entering PSP in the summertime, when our lodging rates are lower. Nonstop flights may be to Las Vegas (LAS), Spirit’s third-largest city, so the flight would not only cater to the local customer but also offer 20+ connecting city options.

• Southwest Airlines: Southwest has also been affected by the grounding of the MAX, which has changed its 2019 growth plans. The airline entered the Hawaii market in March 2019 (their newest domestic market). They informed us they will be focusing on making Hawaii a success before they look at entering other domestic destinations. PSP is one of Southwest’s largest unserved domestic cities. We have a follow-up to share our business/group meetings trends with them. -

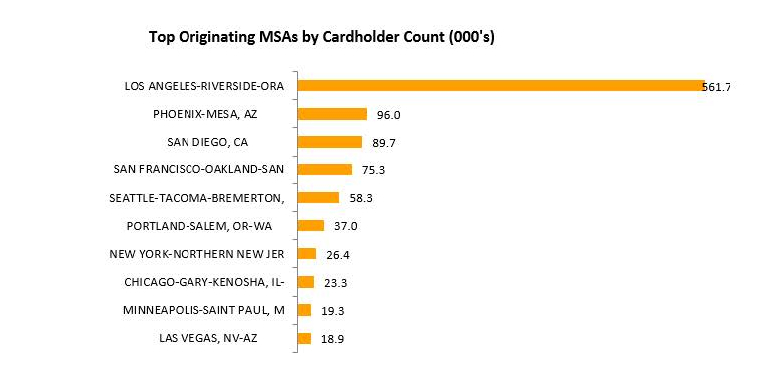

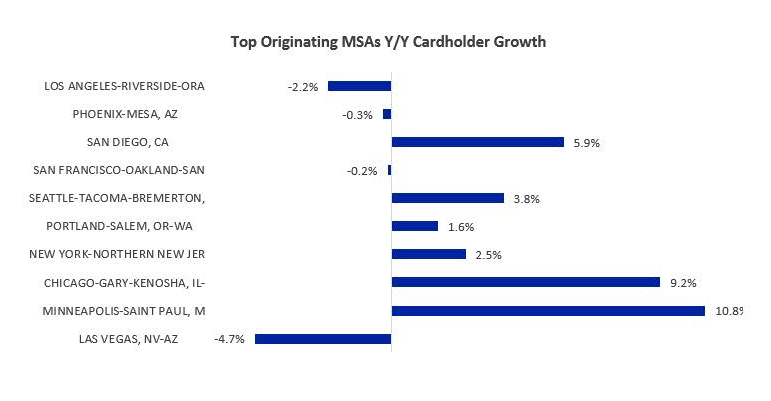

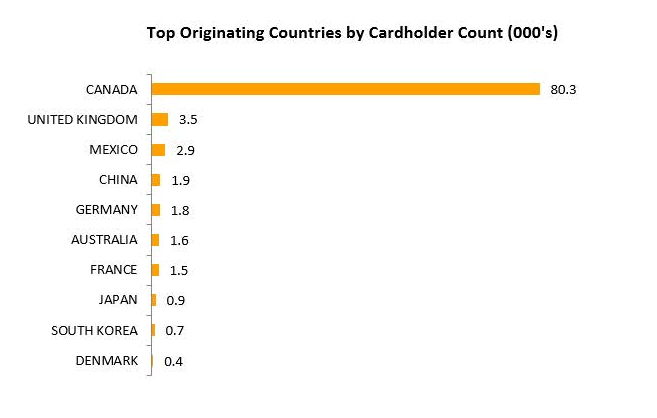

VisaVue Card Trends

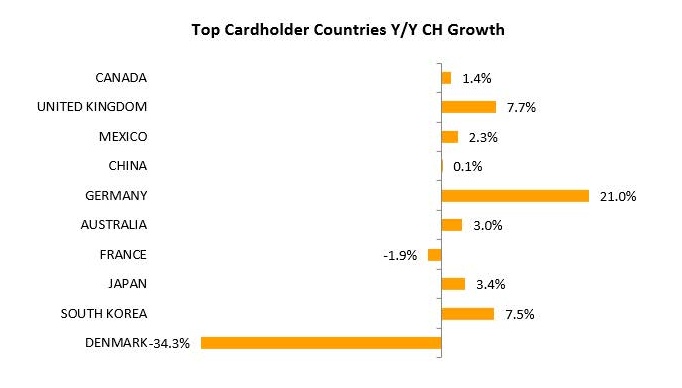

VisaVue tracks non-local cardholder spend in the Coachella Valley. Below are the first-quarter results for both domestic and international visitors. Domestic VisaVue spend for the first quarter was up 1.7%. International VisaVue spend was up .6%.

For more information about Destination Development, please contact:

Bob Thibault

Chief Development Officer

bthibault@gpscvb.com | (760) 969-1339

- Partner Resources

- About Us

-

Visit GPS Updates

- 2-Year Board Priorities

- Current Agenda & Packet

- President's Summary

- Air Service Updates

- Marketing Updates

- Communications & Film Updates

- Digital Updates

- Social Updates

- Convention Sales

- Pace Report

- Partnership Updates

- Tourism Development

- Research Updates

- Smith Travel Research

- Vacation Rental Data

- Finance

- Past Board Meetings Archive

- Destination Marketing

- Research & Reports

- Destination Development Plan

- Regions

- Things to Do

- Stay

- Restaurants & Nightlife

- Visitor Information