GPSTBID for Short-term Vacation Rentals in Riverside County

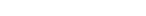

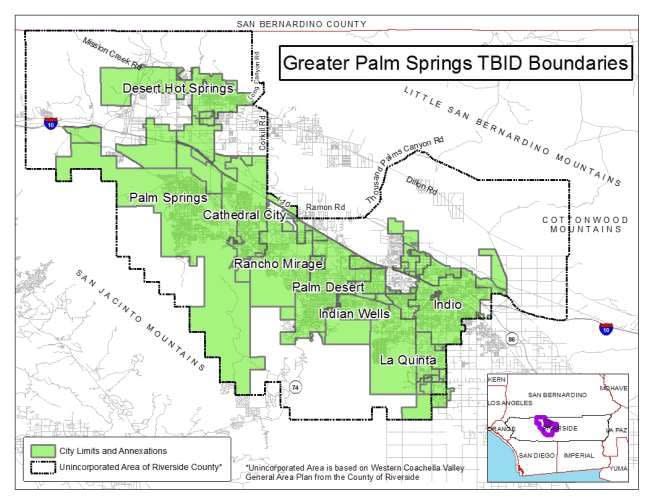

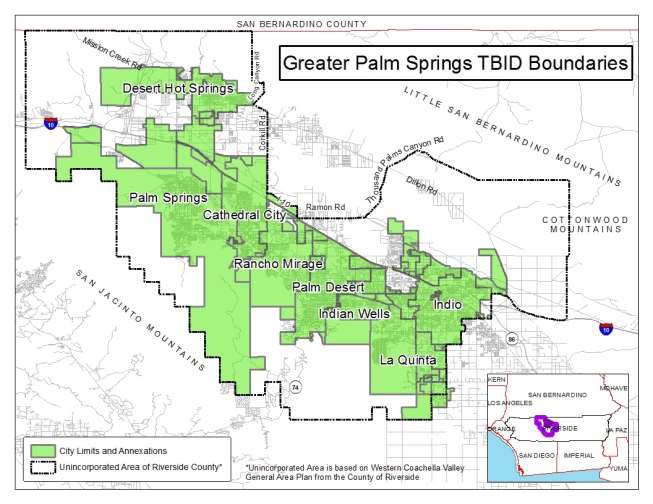

Visit Greater Palm Springs (Visit GPS) is the official tourism marketing agency for the Coachella Valley. Founded in May 1989 by a Joint Powers Authority comprising the cities of Palm Springs, Desert Hot Springs, Cathedral City, Rancho Mirage, Palm Desert, Indian Wells, La Quinta and Indio, and the County of Riverside, Visit GPS was created as a public-private partnership to help grow the region’s tourism economy.

The mission of Visit GPS is to positively affect the destination’s tourism economy and quality of life for its residents, serving the Greater Palm Springs Tourism Business Improvement District (GPSTBID) Partners and providing sales, marketing and public relations support targeting potential leisure travelers from around the world as well as event, meeting and convention groups. In addition to destination sales and marketing, Visit GPS supports air service development, workforce development, consumer and group business research, visitor studies and destination stewardship.

Short-term vacation rentals in unincorporated Riverside County within the boundaries of the GPSTBID are required to pay the 1% GPSTBID assessment on all short-term rental revenue on stays of less than 28 days.

What is a Tourism Business Improvement District (TBID)?

A TBID is an assessment district designed to provide specific benefits to payors by funding tourism marketing and sales promotion efforts for assessed businesses.

Who pays the assessment?

All lodging businesses with 50 rooms or more and vacation rentals located within the boundaries of the cities of Desert Hot Springs, Palm Springs, Cathedral City, Rancho Mirage, Palm Desert, Indian Wells, La Quinta and Indio, as well as portions of the unincorporated area of Riverside County in the Coachella Valley. Boundary maps are available at gpsTBID.com.

How much is the assessment?

For vacation rentals, 1% of gross rental revenue for short-term stays of 27 days or less.

What is included in gross rental revenue?

All non-optional guest fees. This includes rent, resort, cleaning and all other fees required of guests. It does not include optional items, deposits, taxes, or utility reimbursements.

Can I pass this assessment cost onto the customer?

Yes, TBIDs are typically charged to the customer. Generally, visitors are accustomed to being charged these types of fees. Most hosting platforms will let you add them as a separate non-taxable fee. For operators using Airbnb in jurisdictions where Airbnb pays Transient Occupancy Tax for you, you may need to turn on “Professional Hosting Tools” to add the GPSTBID and collect both the assessment and taxes from your renters. Please note, Airbnb and VRBO do NOT remit GPSTBID for you.

When are assessment return forms and payments due?

Forms and payment must be received by Visit GPS by the last day of the month following the reporting period. For homes in unincorporated Riverside County, the reporting period is quarterly.

How much are late penalties?

10% of the assessment amount. The assessment and penalty are charged an interest fee of 1% per month past due. Late payment can also result in being required to pay the cost of collecting the delinquency, including legal fees.

How do I pay the assessment for a short-term vacation rental?

For properties located in unincorporated areas of Riverside County within the GPSTBID boundaries, payment is made directly to Visit Greater Palm Springs each quarter.*

PAYING BY CHECK OR MONEY ORDER

Mail the GPSTBID Return Form along with your payment made out to Visit Greater Palm Springs, Attn: GPSTBID, 70100 Highway 111, Rancho Mirage, CA 92270.

PAYING BY CREDIT CARD

A 3% processing fee will be added to all credit card transactions. Email your GPSTBID Return Form to josh@visitgreaterps.com. An invoice with the amount of GPSTBID and processing fees due will be created for your account within 5 business days and emailed back to you. You can then log in at MyGreaterPS.com to pay your invoice with a credit card.

Payment must be received prior to the delinquent date.

Does this assessment provide marketing opportunities my property can participate in?

Yes! Please contact Josh Heinz at josh@visitgreaterps.com for your login information. You can visit MyGreaterPS.com to learn about opportunities, login to your account, and much more.

Who can I contact with questions?

For questions concerning TBID forms, filing and payments, or adding your listing and marketing opportunities, contact Josh Heinz, Partnership Coordinator at (760) 969-1333 or josh@visitgreaterps.com.

* If your property is not unincorporated County but in a City located within the GPSTBID boundaries, your payment is made directly to that City on the same form you pay Transient Occupancy Tax (TOT). Please visit gpsTBID.com for more information.

Sign up for regular Vacation Rental TBID partner communications here.

Please review the FAQs below for more details on the assessment and benefits.

Additional FAQs (Frequently Asked Questions)

-

How much is the assessment?

The annual assessment rate is a percentage (3% for hotels; 1% for vacation rental properties) of gross short-term rental revenue, calculated monthly in the same way you calculate and remit TOT. Assessments will not be collected on long-term stays of 28 days or more.

The fee is typically passed on to the overnight guest via their nightly rental bill. Travelers in the U.S. have become accustomed to these destination fees, which are standard practice across the country.

-

Who pays into the TBID?

All lodging businesses with 50 rooms or more and vacation rentals located within the boundaries of the cities of Desert Hot Springs, Palm Springs, Cathedral City, Rancho Mirage, Palm Desert, Indian Wells, La Quinta and Indio, as well as portions of the unincorporated area of Riverside County in the Coachella Valley.

-

When do I begin paying the assessment?

Vacation rentals should begin assessing stays July 1, 2021. Assessments for each month are due by the end of the following month to avoid penalties or late fees.

-

How is the assessment calculated?

The TBID assessment is calculated as 1% of gross rental revenue on short term stays of less than 28 day, remitted each month in the same way you calculate and remit Transient Occupancy Tax (TOT).

-

How do I pay the assessment?

The GPSTBID assessment will be remitted by the City (or County for some) that you pay TOT to. An additional line for GPSTBID collection will be added to the forms or platforms you use to remit TOT.

Please note, if you use Airbnb for bookings and your property is located in Desert Hot Springs, Rancho Mirage, Palm Desert, Indio or the unincorporated areas of Riverside County within the GPSTBID boundaries, Airbnb will NOT remit the GPSTBID for you the way they remit TOT. You have a couple different options for collecting and remitting the TBID. Details and instructions for how to set up your account in Airbnb to collect the TBID, in addition to your TOT, are available on their website HERE.

If you do not wish to add the TBID as a pass-through to the guest, you will simply pay the TBID directly to the city/county on the Airbnb exemptions form that you file. -

What is the duration of the TBID Renewal?

The renewed TBID will have a 10-year life, beginning July 1, 2021 and ending June 30, 2031.

-

When will I have access to my Visit GPS account as a vacation rental owner or manager?

Visit Greater Palm Springs will begin loading in vacation rental owner information received from each of our eight cities and Riverside County for permitted homes within our boundaries in the spring of 2021. Once your information is loaded in, an email will be sent to you, or your property manager, with information about how to log in and access your account.

-

Why are Vacation Rentals now included in Greater Palm Springs’ Tourism Business Improvement District?

Local vacation rental agents and owners asked Visit GPS to begin the process of becoming a part of the TBID several years ago. With the renewal of the GPS TBID that started in 2020, all vacation rental permit holders within our boundaries were mailed petitions. With petitions representing over 73% of the district returned in favor of renewing the GPS TBID including vacation rentals, they successfully petitioned to be included.

Vacation rentals are key for our destination to help meet visitor demand during our busiest times of the year, and having them be part of our Board of Directors benefits all of us. The funds collected from vacation rentals for the TBID will be used specifically for marketing and destination development programs designed to bring in more visitors—with a special focus on educating homeowners, neighbors and guests in order to create a positive environment in the local community and improve the vacation rental guest experience.

-

What is a Tourism Business Improvement District (TBID)?

A Tourism Business Improvement District (TBID) is a collection of lodging properties that pay an assessment on individual room night stays. The assessment—a small fee usually paid by guests on their nightly bill—provides funding for destination marketing and development to grow visitation year-round and help the destination remain competitive worldwide.

Over 160 tourism improvement districts exist across the United States, with the majority being in California, including San Diego, Los Angeles, San Francisco, Santa Barbara, Big Bear Lake, Napa Valley, Huntington Beach, Oceanside and Temecula.

The Greater Palm Springs TBID helps us compete with these destinations and promote our many wonderful activities, events, attractions and unique places to stay to visitors around the world.

-

Why does Greater Palm Springs need a TBID?

The TBID provides a stable, long-term funding source to promote tourism, our region’s No. 1 industry. Increasing visitation and room night sales ultimately benefits our hotel/vacation rental businesses and helps grow the local economy. Unlike Transient Occupancy Tax (TOT) collections, which can be used for a variety of purposes, TBID funds are protected for exclusive use by the destination marketing organization (in this case, Visit Greater Palm Springs). The Greater Palm Springs TBID represents 83.7% of Visit GPS' total annual funding.

-

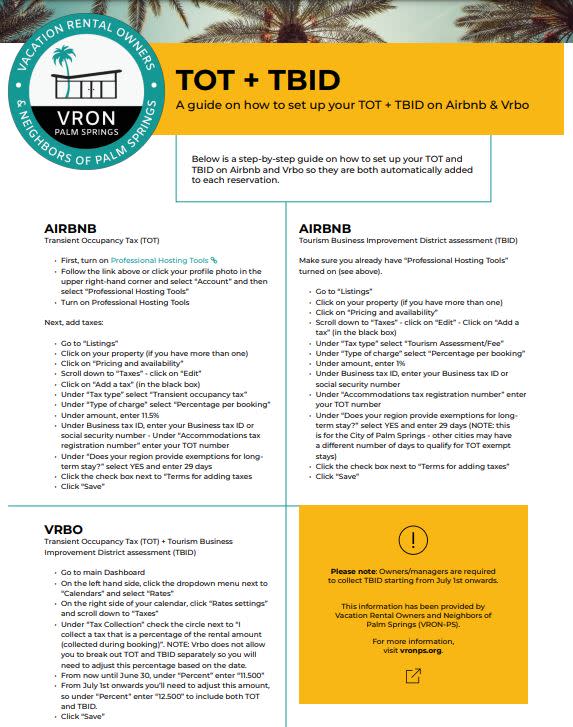

How do I add the TBID Assessment to my Airbnb or VRBO listing?

For homes located in the City of Palm Springs, Click here to download a step-by-step guide on how to set up your TOT + TBID on Airbnb & VRBO.

For all other properties, click here for instructions from Airbnb.